Your Grocery Bill Is Right; The Government Is Wrong

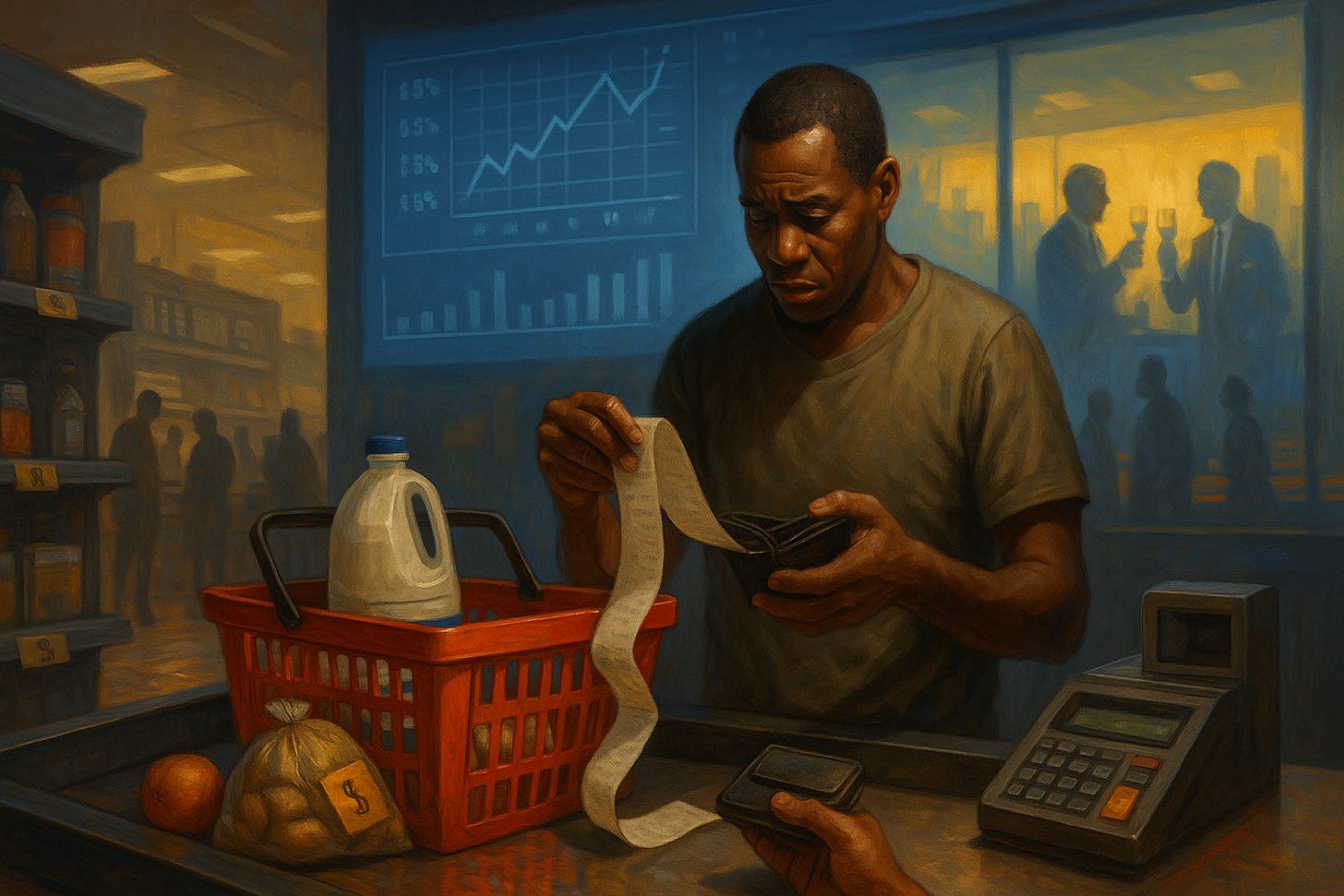

Stats SA reports inflation in neat, single digits. You know better. You’ve watched pap, rice, oil, eggs, taxi fares, school fees, DSTV, and data all climb like nobody’s business.

Every once in a while, you hear it:

“Inflation is under control.”

“The CPI is within the SARB’s target band.”

“Price growth is slowing.”

But then you go to Shoprite or Checkers, and your basket is R200 short. Petrol is up again. Electricity’s eating your budget. Rent just went up. Your salary? Still stuck.

What’s going on? Why does life feel more expensive, but the numbers on the news keep saying everything is “stable”?

The answer is simple: the number they’re using – called the Consumer Price Index or CPI – doesn’t reflect your life. It’s not designed to. It’s designed to paint a picture that works for policy and politics, not for people trying to survive month to month.

The CPI

The CPI is meant to measure how much the cost of living goes up over time. To do that, Stats SA tracks the prices of a basket of goods and services they think an “average South African” buys: bread, milk, taxis, school fees, airtime, etc.

Sounds fine in theory, but in practice, the “average basket” they use isn’t yours, and the way they calculate changes is full of adjustments that don’t make sense to normal people.

Take this example:

Let’s say your electricity bill went from R800 to R1,200 a month. You’re paying more—full stop. But if government statisticians think you’re using better appliances, or getting more “value,” they might say it didn’t increase that much. In other words, they “adjust” it. Same with cars, phones, housing, anything they think has improved in quality gets partially discounted, even if you’re spending more in rands.

It’s a quiet trick. They say prices didn’t rise as much, because “what you’re getting is better.” But your wallet doesn’t care about theory. You just know you’re spending more and getting less.

Why it matters

That CPI number isn’t just for headlines. It determines how much pensions go up. How wage negotiations are framed. How the Reserve Bank sets interest rates. If the CPI says inflation is 5%, and your actual costs went up 12%, you lose. End of story.

It benefits government. It benefits big corporates. It keeps wage increases low, and interest rates “on target.” Meanwhile, your grocery ever increasing bill stares you in the face.

It’s not just working-class South Africans feeling it, middle-income families are slipping. Petrol alone eats thousands every month. Kids’ school shoes cost what adult shoes used to. Load shedding means buying inverters and generators, and none of that’s in the CPI basket in the way it hits your budget.

Here’s the quiet scandal: serious economists – local and global – have called this out. They’ve said for years that CPI is a weak way to track the real damage inflation causes. Economists from the Austrian school have torn it apart, arguing that inflation is about how much new money is being pumped into the economy, not just what shows up on supermarket shelves.

And even economists who aren’t free market hardliners agree: CPI ignores the worst parts of cost-of-living pressure – housing, transport, energy, education. Especially in a place like South Africa, where inequality is so wide and basic goods are a massive part of people’s spending.

Stats SA reports inflation in neat, single digits. You know better. You’ve watched pap, rice, oil, eggs, taxi fares, school fees, DSTV, and data all climb like nobody’s business. But your take-home pay hasn’t.

So, the next time someone says, “Don’t worry, inflation is well managed,” ask them when last they bought meat. Ask them if they’ve filled up a tank lately. Ask them how a family of four is supposed to live on CPI fiction.

Because that’s what it is. A number that smooths over your pain to make official policy look clean.

It’s not that inflation isn’t real. It’s that the way it’s measured hides how real it is for the people who can least afford it.

Econ Bro (@EconBreau and @EconBreau2 on Twitter/X) is a Nigerian Austrolibertarian economist and an apprentice at the Mises Institute. Under the organisation name “The Freedom Institute” he teaches individual liberty, personal responsibility, private property rights, free markets, and sound money to mostly young people across Nigeria. Econ Bro is an Associate of the Free Market Foundation.

This is just a fact unfortunately. The CPI calculation includes too many subjective factors, governments can't be responsible for measuring inflation, tackling inflation and also be the ones who benefit from inflation. It's clear what the incentives are.